In 2025, fixed deposits at the post office remain one of the safest investment options for individuals who seek guaranteed returns. Interest rates are sometimes even higher than those of regular savings accounts; hence, with the backing of the government, these FDs are preferred by conservative investors. The Post Office FD calculator makes it easier to calculate the maturity amount for any given investment, thus helping in planning and setting goals.

What is a Post Office FD?

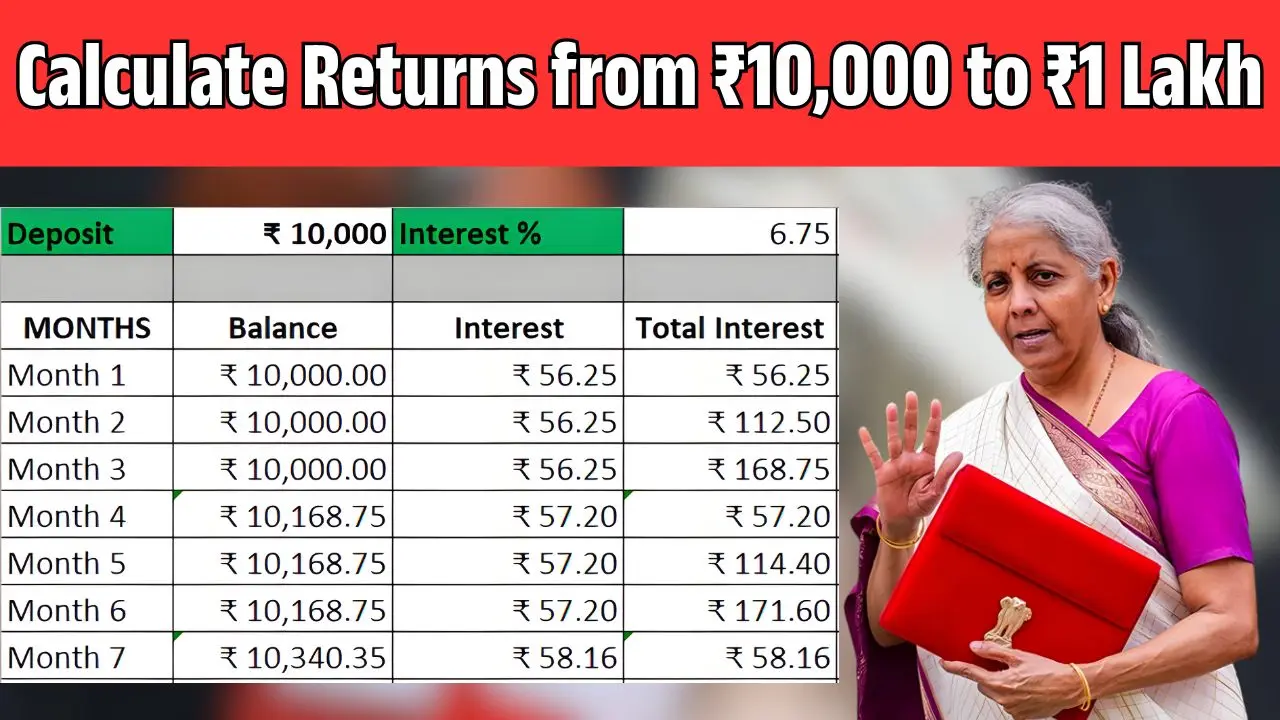

Post Office Fixed Deposit (FD) implies a term deposit where the investors tie up a lump sum amount for a fixed tenure of 1 to 5 years. The FD earns interest at a fixed rate declared by the government and this interest is compounded quarterly. After the maturity, the investor receives the principal along with accrued interest.

How the FD Calculator Works

The Post Office FD calculator lets you enter investment amount, tenure, and interest rate prevailing to know the maturity value. May it be an investment of ₹10,000; ₹25,000; ₹50,000; or ₹1 lakh, the calculator will give you an accurate picture of your returns so that you don’t have to crunch the figures by yourself. It accounts for quarterly compounding of interest and ensures full transparency in these projections.

Advantages of the Calculator

The calculator helps the investors plan well by giving the prospective returns for different amounts of deposit. The calculator simplifies comparison among different tenures and rates to decide between investing monthly or in lumpsum and setting realistic goals. Knowing beforehand the expected maturity value can help an investor consider their FDs as meeting future costs for their children, such as education or marriage, or spending through retirement.

Sample Returns on Popular Investment Amounts

As an example, an amount of ₹10,000 will accumulate to approximately ₹14,000 at the end of 5 years in an FD at 6.7% p.a. interest compounded quarterly. Same way, ₹25,000 matures to around ₹35,000, ₹50,000 to about ₹70,000 and ₹1 lakh to nearly ₹1.4 lakh over the same tenure. Thus we see that even small amounts grow considerably with risk-free government returns.

Why Post Office FDs are a Safe Option

The Post Office FD is fully backed by the Government of India, offering complete capital safety. Guaranteed returns do not waver with market fluctuations, unlike expectations from market-linked investments. Some provisions exist permitting withdrawals, albeit premature and subject to penalties, in case of emergencies.

Conclusion

A Post Office FD calculator in 2025 thus serves investor needs to plan, compare, and decide upon the safest investment option efficiently. Knowing maturity amounts for investments ranging between ₹10,000 and ₹1 lakh allows one to make informed decisions in keeping with one’s financial goals. These government-backed FDs promise security and fixed returns, making them a safe tool for conservative wealth creation.