One of the simplest yet most effective ways to build wealth over time is an investment through a Systematic Investment Plan (SIP). Even small amounts of ₹2,000 per month, if invested smartly and consistently, can amount to a handsome corpus of ₹7.6 lakh. SIPs make mutual fund investing accessible to everyone who wants to achieve long-term financial goals but lacks heavy initial funds.

How ₹2,000 Turns into ₹7.6 Lakh

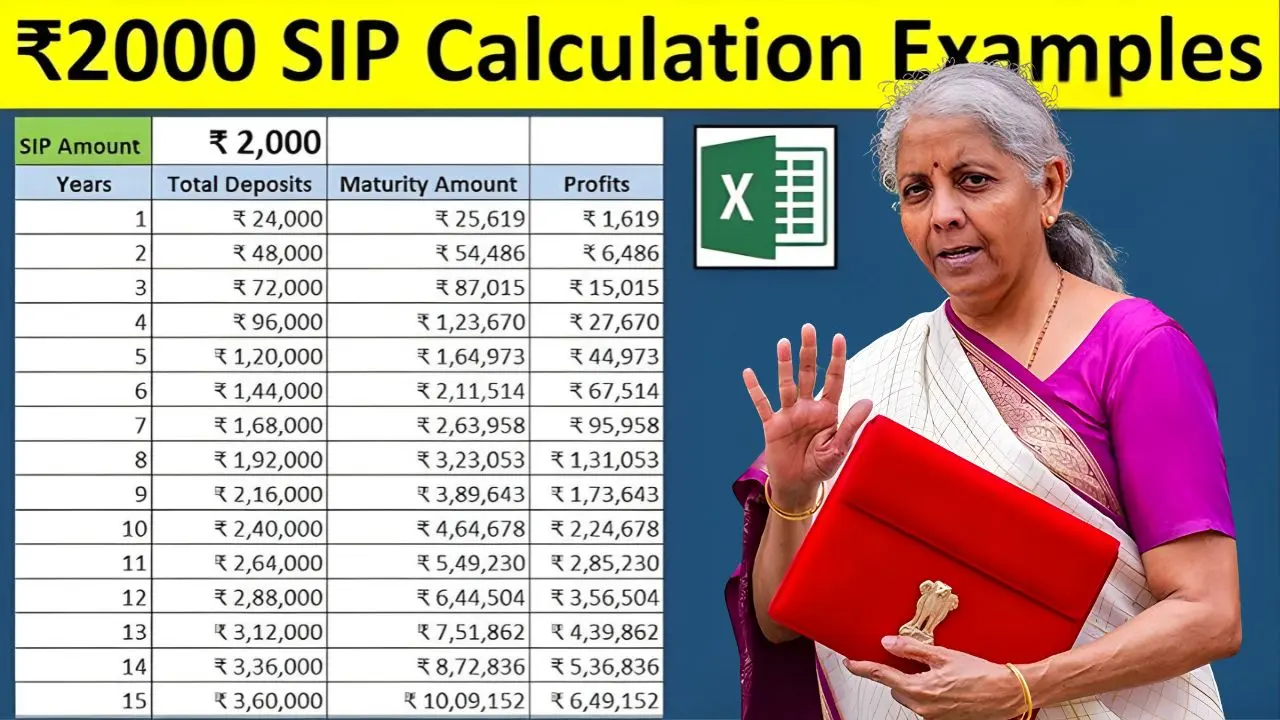

So, what is really working behind this wonderful growth of SIP? The answer is compounding and disciplined investing. For instance, if you put away ₹2,000 each month in a mutual fund that gives an average of 12% returns per annum, your investment would swell to nearly ₹7.6 lakhs after 15 years. Growth keeps happening because returns are earned on every monthly contribution, and those returns start fetching income for the investor themselves. The more they stay invested, the more compounding will work for them.

Suitable for first-timers and Long-Term Investors

A ₹2,000 SIP is suitable for a beginner, who chooses to start with little funds, all the while aiming to build wealth consistently. The SIP also fits working professionals who wish to invest regularly without pondering market volatility. The flexibility of SIPs lets investors boost their contributions or halt cash flow for some time, depending on where they stand financially. This way, SIP investment is a more convenient and stress-free option.

Why SIPs Will Still Be the Best Investment Option in 2025

With markets staying dynamic and inflation rising in 2025, the SIP remains one of the stable, systematic means of percolating wealth. SIPs enable investors to rupee-cost-average, where one would be able to buy more units when the prices are low and less when the prices are high, to even out the returns over a period.

Conclusion

A monthly SIP of ₹2,000 with discipline can turn into a phenomenal ₹7.6 lakh in the very long run. This simply states that small but regular investments can create big money over time. Patience, due diligence, and knowing a kind of mutual fund plan that works with your long-term perspective on finances are the key ingredients to this recipe.