The Employees’ Provident Fund (EPF) is one of the most reliable retirement savings schemes for salaried employees in India. It not only helps build a financial cushion for the future but also ensures stable, tax-free returns through annual interest credited by the Employees’ Provident Fund Organisation (EPFO). Understanding how EPF interest is calculated can help employees track their savings more accurately and plan their long-term finances better.

Understanding EPF Contributions

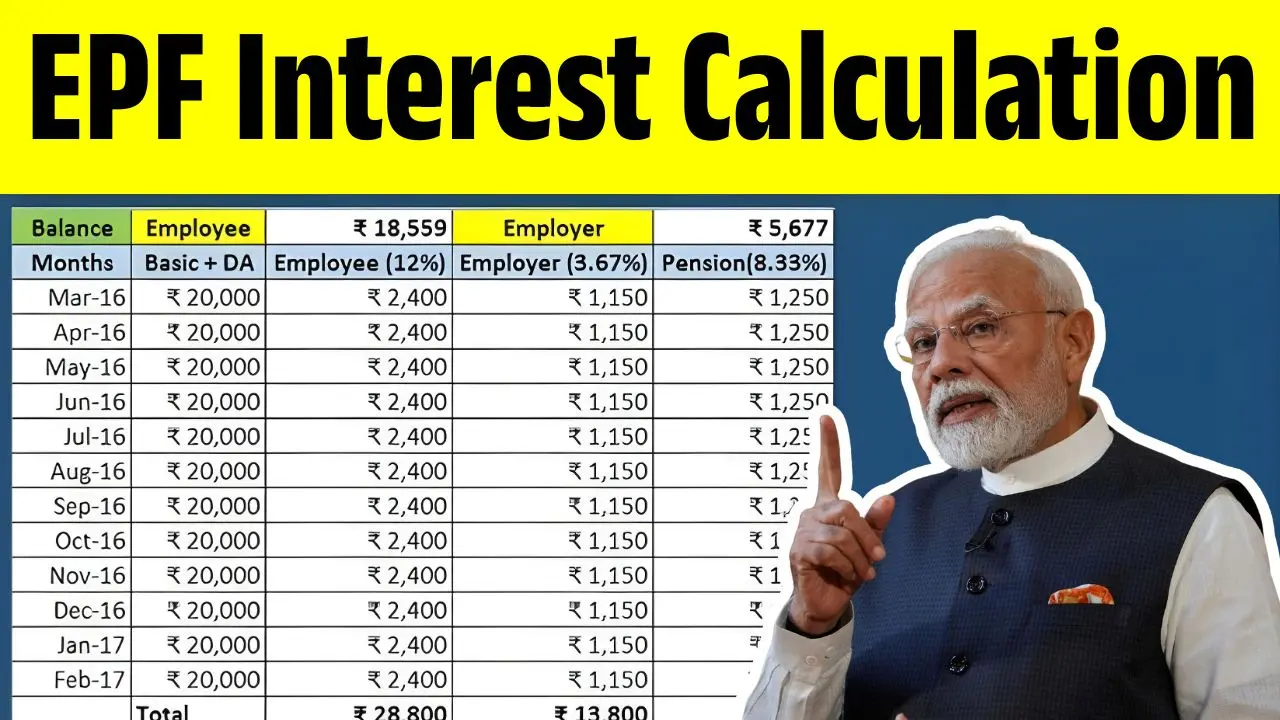

Each month, both the employee and employer contribute 12% of the employee’s basic salary and dearness allowance to the EPF account. While the employee’s entire share goes into the EPF, a part of the employer’s contribution (8.33%) is directed toward the Employees’ Pension Scheme (EPS), and the remaining 3.67% is added to the EPF balance. These monthly contributions form the basis for interest calculation.

How EPF Interest Is Calculated

The EPFO announces the interest rate every financial year—currently around 8.25%. The interest is calculated monthly but credited to the employee’s account at the end of the financial year. The calculation is done on the closing balance of each month, taking into account the total of the opening balance, monthly contributions, and withdrawals, if any.

For instance, if your EPF balance at the start of the month is ₹5 lakh, and you and your employer together contribute ₹10,000, interest for that month will be calculated on ₹5,10,000. The monthly interest rate is derived by dividing the annual rate by 12. The total interest accumulated during the year is added to your EPF balance on March 31.

Why EPF Interest Matters

The compounding effect of monthly interest makes EPF one of the most effective long-term investment tools. Over time, even moderate contributions grow into substantial savings, providing financial security after retirement. Moreover, EPF enjoys tax benefits under Section 80C, and the accumulated amount, including interest, is tax-free upon withdrawal after five years of continuous service.

Conclusion

EPF interest calculation may seem complex, but it works entirely in favor of the employee through consistent compounding. Regular monitoring of contributions and understanding how interest is added can help employees make the most of this government-backed savings scheme.