The Post Office Recurring Deposit (RD) is a trustworthy savings scheme backed by the government, where an individual saves a fixed sum every month with assured returns. People looking to build a sizable corpus over a period of time with minimal risk can go in for a Post Office RD. By investing ₹5,000 every month, investors get the benefit of disciplined savings and compound interest.

Working of Post Office RD

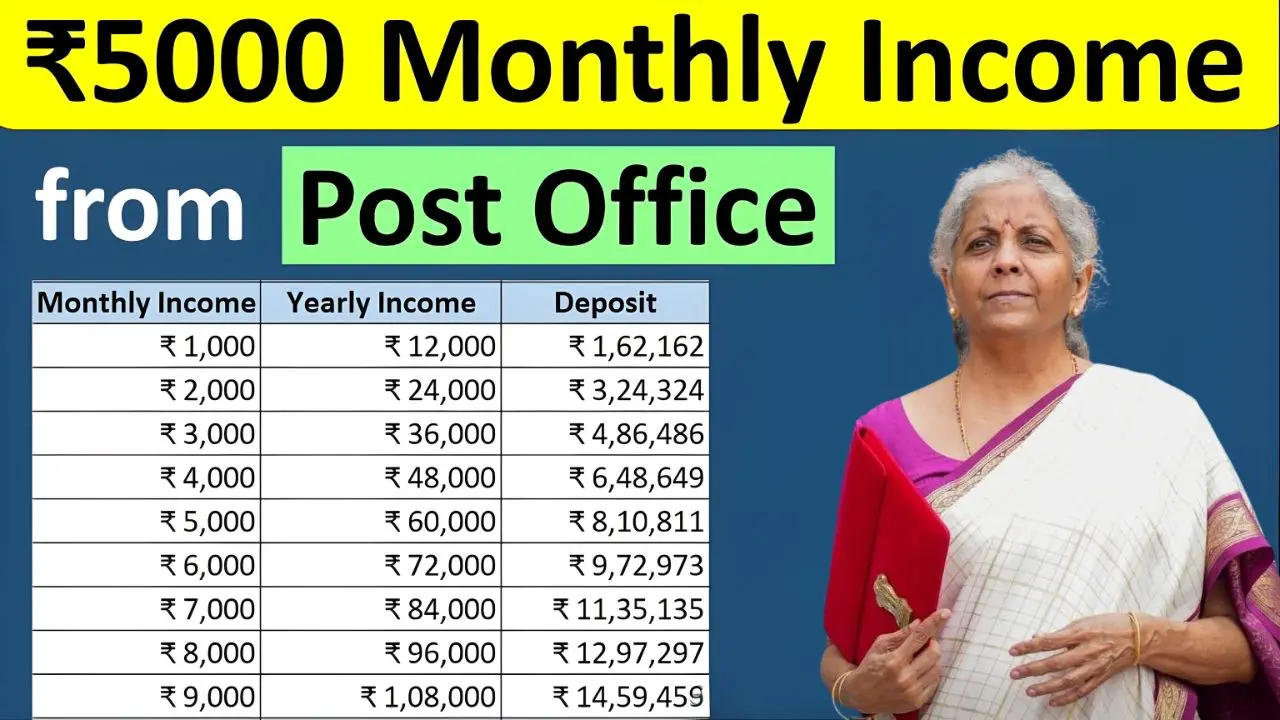

The Post Office RD scheme offers a deposit account with a minimum deposit of ₹100, thereby keeping it open for the common populace. However, putting in ₹5,000 monthly helps in considerably enhancing the maturity value toward big savings. The RD comes with a fixed tenure for the period of six months to 10 years, and interest is compounded quarterly. The rate of interest keeps undergoing periodic revisions, but as of 2025, it stands a competitive rate of 7.9% per annum, greater than many fixed deposit rates offered by banks.

Advantages of ₹5,000 Monthly Investment

Put your money, ₹5,000 every month; you have built a disciplined savings habit plus an amount of lump sum over the period of RD. For instance, currently, investing ₹5,000 monthly over 10 years at the current interest rate yields a maturity amount of ₹8-9 lakhs (depending on the prevailing interest rates). The scheme being fully government-backed also ensures the safety of investments, with zero risk to the loss of principal.

Flexibility and Ease of Management

RD schemes are easy to manage and flexible concerning deposits and tenure. Accounts can be opened by any person over 18 years of age, with the facility of nomination to ensure transfer of the money to his nominee. The monthly deposit can be made at any post office across the country, thus providing convenience to investors everywhere – in urban or rural areas.

Conclusion: Safe Path to Your Goals

Investment of ₹5,000 per month in a Post Office RD is one of the simplest yet most effective methods for achieving your long-term financial goals. Since it ensures discipline in savings, offers attractive interest rates, and is fully guaranteed by the Government of India, it remains one of the safest investment avenues for an individual. Whether candidates wish to save for wealth creation, future education, or retirement, a Post Office RD can aid in turning disciplined saving into a sizeable financial corpus.