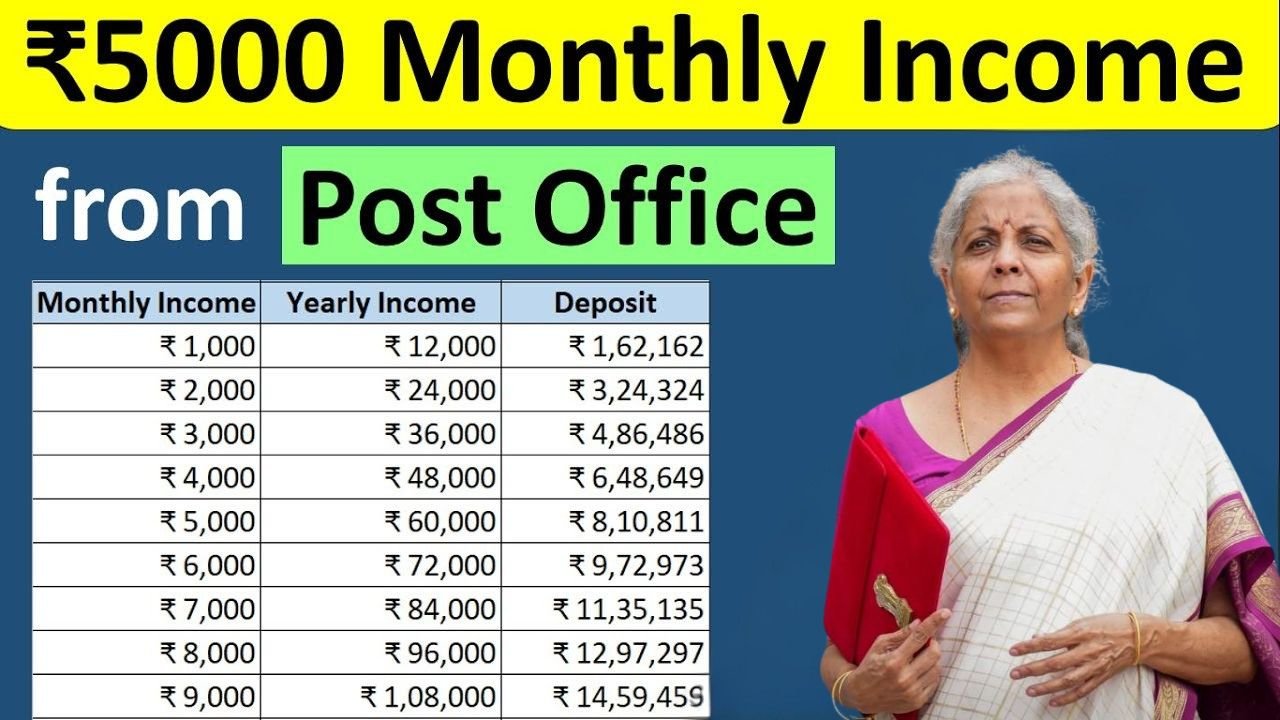

By the year 2025, Post Office schemes continue to attract investors with risk aversion, preferring stability and government-backed assurance. Among such plans is one through which you can invest as little as ₹5,000 per month and build a sizeable corpus over the years through interest and contributions. Disciplined saving of this amount on a monthly basis during the tenure could grow up to an amount of almost ₹16.27 lakh including both contributions and interest.

Which Scheme Gives Such Returns?

The Post Office Recurring Deposit (RD) lets investors deposit a fixed sum every month for compound interest. With a lucrative interest rate of nearly 6.7% per annum in 2025, the RD is a big draw among salaried people and small savers looking for guaranteed maturity value. The interest is compounded every quarter so that it grows steadily.

How ₹5,000 Turns Into ₹16.27 Lakh

Say you invest ₹5,000 every month for 10 years in a Post Office RD; your total investment is ₹6 lakh. Quarterly compounding at the present interest rate carries this sum to about ₹16.27 lakh at maturity. This says a lot about disciplined savings and the compounding offered by Post Office RD. The returns on this product are the full-well-known and risk-free, unlike a market-based product.

Advantages of Post Office RD

A few advantages of an RD include that an investor can begin investing with as low as ₹100 per month, which makes it accessible to all the income groups. Accounts can be opened in the name of one or more persons or even in the name of a minor, encouraging financial discipline among families. Early withdrawal of funds is permitted after a certain period, granting some needed flexibility in times of financial need.

Safety and Accessibility

Being a Government of India-backed scheme, Post Office RD Investment is very safe. With over one and a half lakh post offices across the country, accessibility is never an issue, even in remote rural areas. This makes the scheme one of the most inclusive financial products available to Indian households.

Taxation Rules for Investors

Interest income from Post Office RD is taxable. But still, the certainty makes RD an attractive saving option. Those who would rather have a tax-free lump sum at maturity could go for PPF or Sukanya Samriddhi Yojana. RD will be among the best choices for those looking at short- or medium-term disciplined saving.

Who Should Invest in This Scheme

Ideal for salaried employees, middle-income families, and anyone wanting to develop a future fund for education, marriage, or household needs and so forth. Its ease, assured returns, and minimal entry barrier make it the first go-to for the first-time saver as well as conservative investors.

Conclusion

Post Office Recurring Deposit Scheme, 2025 shows how, with a little saving here and there, over time you’ll be able to build a huge corpus. Saving ₹5,000 every month will ensure you gather ₹16.27 lakh with complete safety. Anyone looking for a secure savings avenue that grows with guaranteed interest rate can consider a Post Office RD as a time-tested option.