Mutual funds have seen a rise in popularity as investment avenues, with medium- to long-term wealth creation being the prime focus. Among those considered, SBI Mutual Funds, with their consistent performance and experienced fund management teams and a wide gamut of investment avenues, stand tall. For a five-year horizon, the appropriate choice of an SBI mutual fund can assist in balancing risk and returns.

Why Is It Necessary to Invest in SBI Mutual Funds?

Experienced fund managers subject the SBI Mutual Funds to stringent discipline, aiming at returning consistent returns. Their funds cater to various risk appetites, ranging from equity-oriented schemes to hybrid and debt funds. SBI Mutual Funds, with their in-depth research capabilities and heavy presence in the Indian markets for years, stand the test of time and are now considered trustworthy by new and experienced investors alike.

Best For-5 Years Perspective

Stocks and shares mutual funds at SBI offer the best growth and stability combination for a five-year investment horizon. SBI Equity Hybrid Fund and SBI Bluechip funds have a rich history of producing outstanding returns, with the equity side promising growth and the debt working as a safe side. These funds attempt to profit on upward market movements, yet also serve to protect against major declines, therefore making them preferred funds for medium-term investors.

Expected Returns and Risk Profile

Historic returns ranging from 10-15% have been generated by SBI mutual funds over a working horizon of 5 years, although these returns are dependent on market conditions and cannot be guaranteed for the future. Hybrid funds are thus about medium risk; they are most appropriate for investors whom while desiring a superior rate of return over fixed deposits want protection from full exposure to downside fluctuations.

How to Invest in SBI Mutual Funds

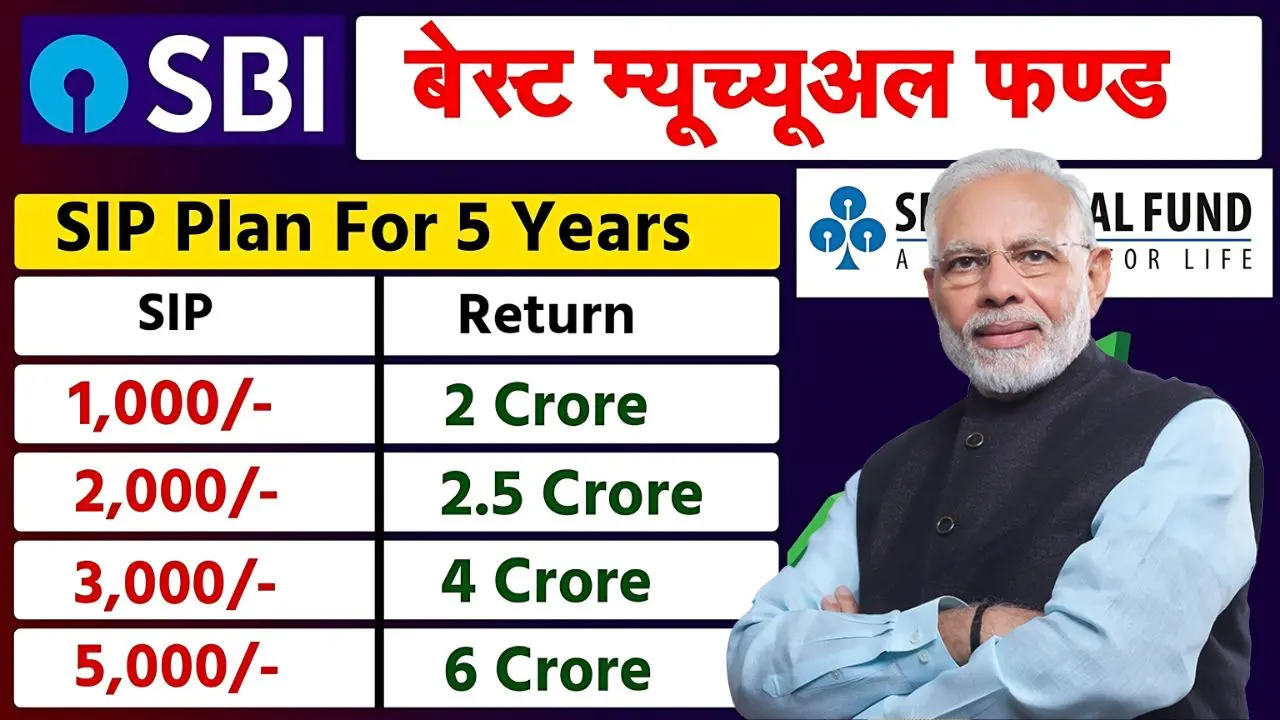

The step of investing in SBI mutual funds is simple and can be performed online or through authorized distributors. For a five-year investment, SIPs are preferred, wherein investors put aside small amounts regularly and avail rupee cost averaging. Investors also keep track of funds’ performances and make changes to investments as per their changing financial goals.

Final thoughts

Investing in the best SBI mutual fund for five years can prove to be an excellent way of wealth creation, simultaneously managing risk. A fund like SBI Equity Hybrid Fund and SBI Bluechip Fund gives a balanced approach to an investor who wants to take medium risk and get medium returns. So, stay conscious of planning and periodic evaluations; SBI’s mutual funds are definitely the way to go for medium-term wealth accumulation.