The Post Office Public Provident Fund is one of the most trusted long-term saving schemes in India. Being backed by the Government of India, a PPF will be a guaranteed return scheme. The security of investment, coupled with the benefits under the Income-tax Act, has thus made this scheme a favorite among those who think about retirement or long-term wealth creation.

Interest Rate and Tenure

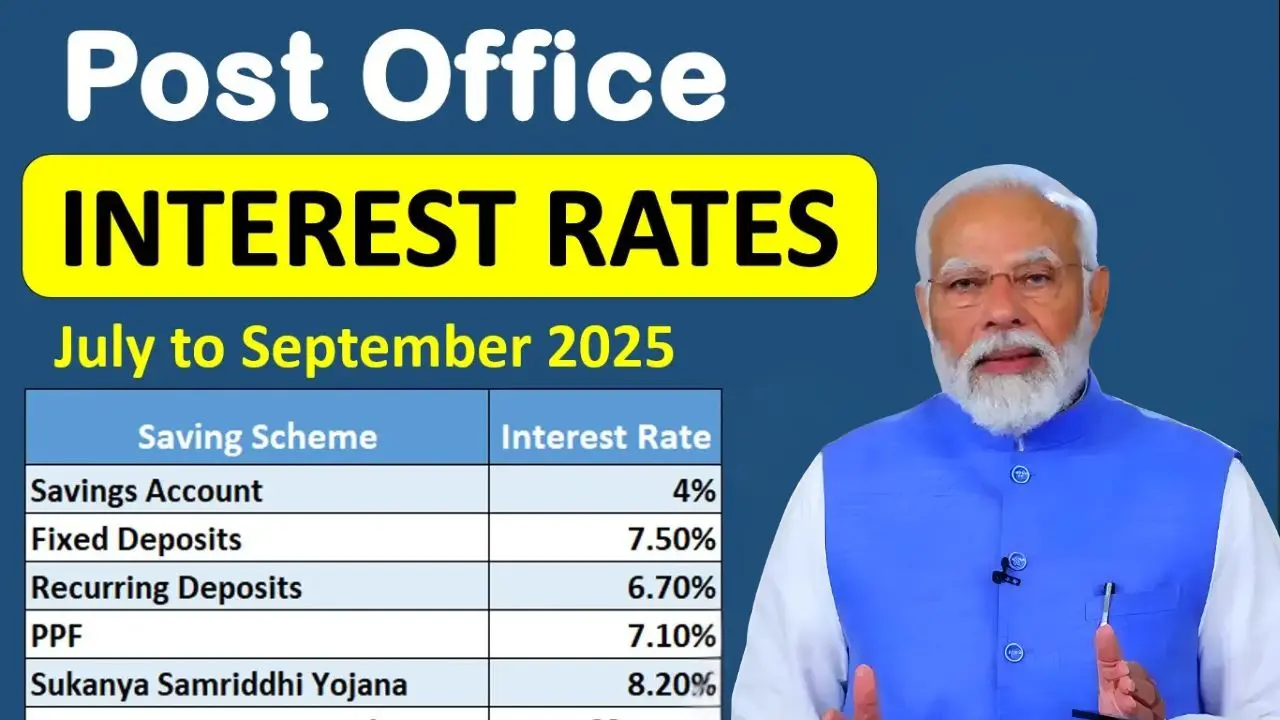

For 2025, the Post Office PPF renders an interest rate of 7.1% per annum compounded annually. The rate is reviewed at the end of every quarter by the Ministry of Finance. The scheme is locked for a period of 15 years after which it can be renewed for another 5 years’ block of time. However, the funds stay locked for a duration of 15 years with the provision of partial withdrawals from the 7th financial year, thus providing investors with flexibility whenever needed.

Minimum and Maximum Investment Limits

Investors may open PPF account against a minimum contribution of ₹500 per annum, thus opening the door of this investment to almost anybody. However, the maximum yearly contribution allowed is ₹1.5 lakh, as deposits can be made either in lump sum or through installments for the whole year. An account can be arranged at any post office or at any authorized bank, with digital payment made possible for an extra-bit of ease.

Tax Benefits Under Section 80C

One of the major attractions of the PPF scheme is this very Exempt-Exempt-Exempt (EEE) tax status. Contributions made to the account are eligible for deduction under Section 80C of the Income Tax Act, the interest earned is tax-free, and the maturity amount is also completely exempt from tax. Triple benefits indeed make PPF one of the most tax-efficient investment choices in India.

Why PPF Was Still a Popular Choice in 2025

Throughout the volatile times of fluctuating returns, the Post Office PPF continues to embody steadiness and reliability. This government backing ensures a fixed interest rate and unassailable tax advantages; thus, one must have it in their long-term portfolio. In 2025, those looking for the safest, most disciplined, and rewarding investment route will find the Post Office PPF still the best choice.