Join the bandwagon of prudent Indian investors who still opt for Post Office FDs that promise return with government guarantee. Since 2025 witnesses certain jittersin interest rates dictated by the economic parameters, a smart investor needs to use Post Office FD Calculation tool to plan their investment. These calculators take the investors through finding the potential return from the deposits, planning deposit amounts, or any other financial decisions.

Post Office FD Explained

These deposits have government backing for any KYC procedure and pay a fixed rate of interest for a pre-established period, usually ranging from 1 year till 5 years and even more. The schemes are considered very safe and are, therefore, perfect for anyone seeking secure investment. Interest rate fluctuates according to the tenure of the deposit, though the Post Office keeps revising the rates to stay a step ahead of inflation or market behavior.

How Does the FD Calculator Work?

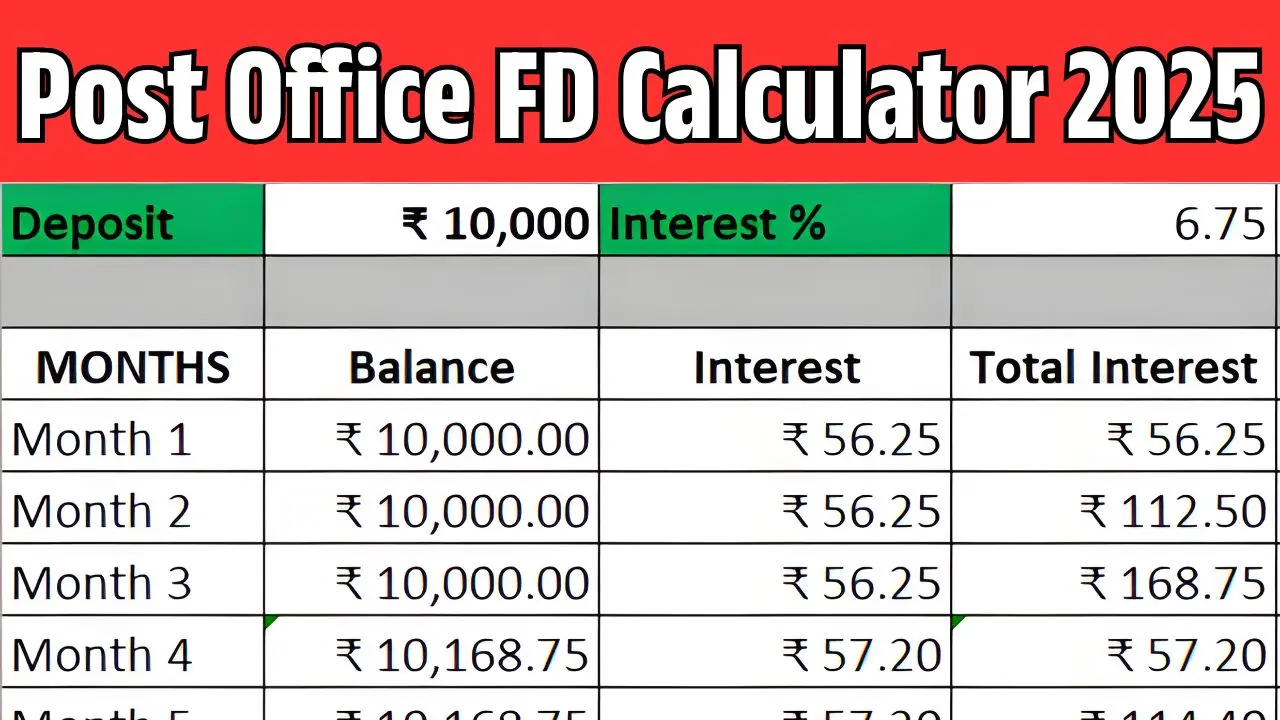

The Post Office FD Calculator for the Year 2025 makes investment planning straightforward for the user who specifies the amount to deposit, tenure, and interest rate applicable. The calculator computes the maturity amount with compounded interest, thus showing clearly what the returns will be. This tool is of assistance to investors comparing tenures, planning for financial goals, and deciding on optimal investment plans, without going through the manual route of calculation.

Benefits of Using an FD Calculator

The FD calculator helps investors with strategic decision-making, giving a correct estimation of the earnings and whether one should lay down a lump sum or recurring deposit plan. The calculator also highlights the difference between reinvesting the interest as against withdrawing it at regular intervals. This informs their decisions in the planning for retirement, education funds, or emergency funds.

Conclusion

The Post Office FD Calculator 2025 Regular represents an indispensable tool for safe investment and systematic wealth creation. With interest rates fluctuating and several tenure options to choose from, the calculator helps the investor to assess the correct deposit amount to be placed, comprehend the potential return thereof, and proceed confidently along the way toward actualisation of their financial goals. By working with this tool, one has every chance to make smarter investment decisions through the means of security and trust offered by fixed deposits of the government.