With increased demand for two-wheelers in India, bike loans have become a mode of financing for buyers who prefer flexible financing over paying upfront. Buyers can use EMI calculators in 2025 for estimating monthly installments and find the appropriate loan plan to fit their budget.

A ₹2 lakh bike loan is mostly an option of financing chosen by middle-class buyers, but the EMI payment and interest outgo depending on the lender, rate of interest, and tenure can have huge variations. Therefore, it is essential to understand these conditions for clairvoyant financial planning.

How EMI is Calculated

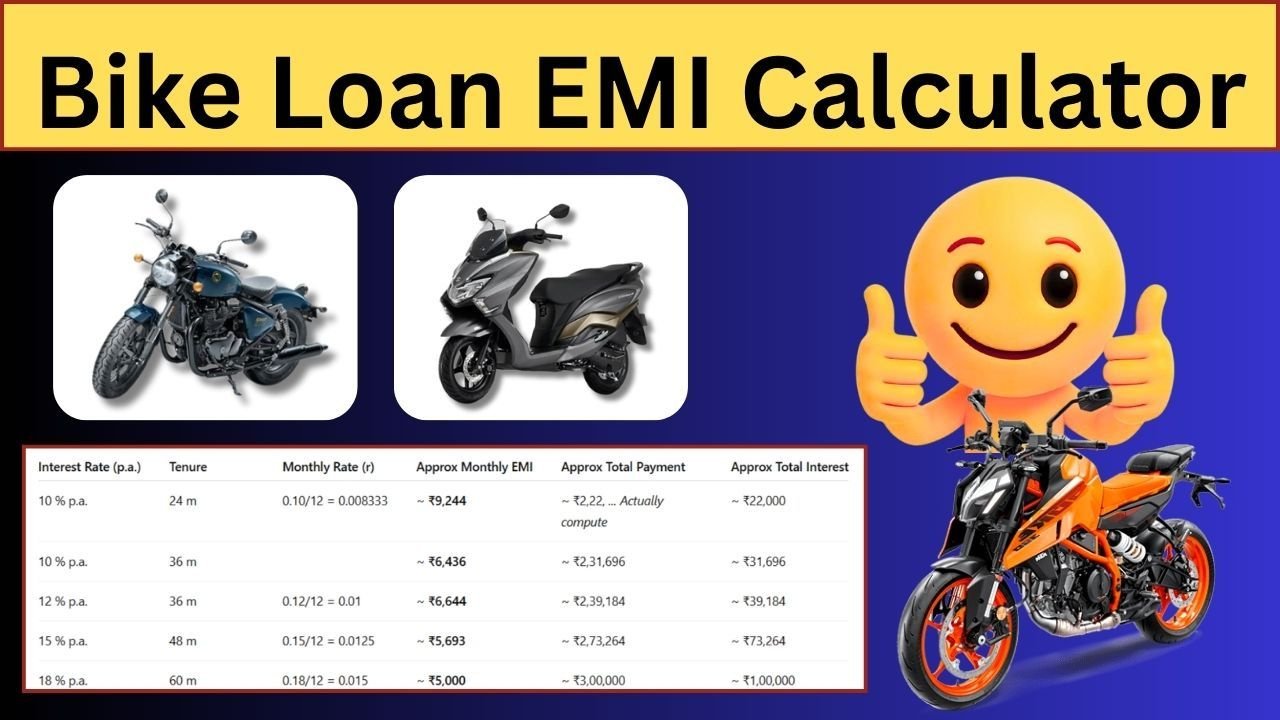

The Equated Monthly Installment (EMI) is based on three primary considerations-key: principal amount, interest rate, and the tenure of the loan.

For this bike loan amounting to ₹2 lakhs, at an interest rate of 11 percent per annum for 3 years, there will be an approximate monthly EMI payment of ₹6,600, with a total of about ₹37,600 to be paid as interest.

If an individual can pay a higher EMI for a shorter span, it will help them save interest. On the other hand, a longer tenure becomes easier to pay out but increases overall interest.

How to use the Bike Loan EMI Calculator

Online EMI calculators are free for use and provided by most banks and financial institutions. The utility of these tools lies in letting borrowers enter the loan amount, tenure, and interest rate to calculate the payment they will have to make monthly.

An EMI calculator helps buyers to:

- Compare various lenders and interest rates.

- Choose a tenure that the instalment fits the monthly budget.

- Know the total repayment and interest outgo before entering into a loan bond.

For example, changing tenure from a 3-year one to a 2-year one may raise EMIs to roughly ₹9,000 per month, but reduce interest to about ₹18,500, and offer substantial savings.

Some Tips To Get The Best Bike Loan Plan

- Compare Interest Rates Across Lenders – Public sector banks, banks, and NBFCs offer various unusual rates.

- Check Processing Fees and Other Charges – Lesser processing fees would cut the upfront cost.

- Go For Options That Allow Prepayment Or Part-Payment – Many lenders allow prepayments or partial payments on the principal amount, thereby reducing interest cost.

- Choose The Tenure Carefully – Shorter tenure leads to lesser interest but high EMI, whereas long tenure has higher interest but low EMI. So, choose the tenure by considering these.

- Consider The Insurance And Maintenance Cost – The true monthly outflow for the concerned person is more than the EMI.

Advantages of an EMI Calculator

Clarity and control over finances, the borrowers can use an EMI calculator to plan their monthly budget accurately, to avoid defaults, and to make an informed decision about loan tenure and affordability.

It can let the purchaser select between increasing and/or decreasing interest rates or a partial prepayment to identify the least expensive bike loan plan.

Conclusion

A ₹2 lakh bike loan in 2025 is managed successfully by an EMI calculator to forecast what one would pay as installments or interest. By carefully selecting loan tenure, interest rate, and lender, the borrower may even save some money on the side, cut down on the financial strain, and have fun riding.

Potential buyers are urged to use the EMI calculators before finalizing a loan just to ensure that they are financially balanced throughout the time they purchase the bike of their dreams.