Even in 2025, the Post Office Monthly Income Scheme continues to earn high acclaim from investors who seek safe and steady income. It is much sought-after by the retired, the aged, and those who would settle for guaranteed returns instead of anything that depends upon the markets. The scheme, being a government assured instrument, gives one the assurance of financial security and of receiving monthly payouts on a predictable basis.

What is the Post Office Monthly Income Scheme?

The Monthly Income Scheme is a government-initiated saving scheme where the investors keep a one-time deposit and receive fixed monthly interest payments. This ensures that an individual has a regular income for the tenure and safety of the principal capital, hence suitable for an individual who needs cash flow on a day-to-day basis.

How a Monthly Deposit of ₹5,000 Works

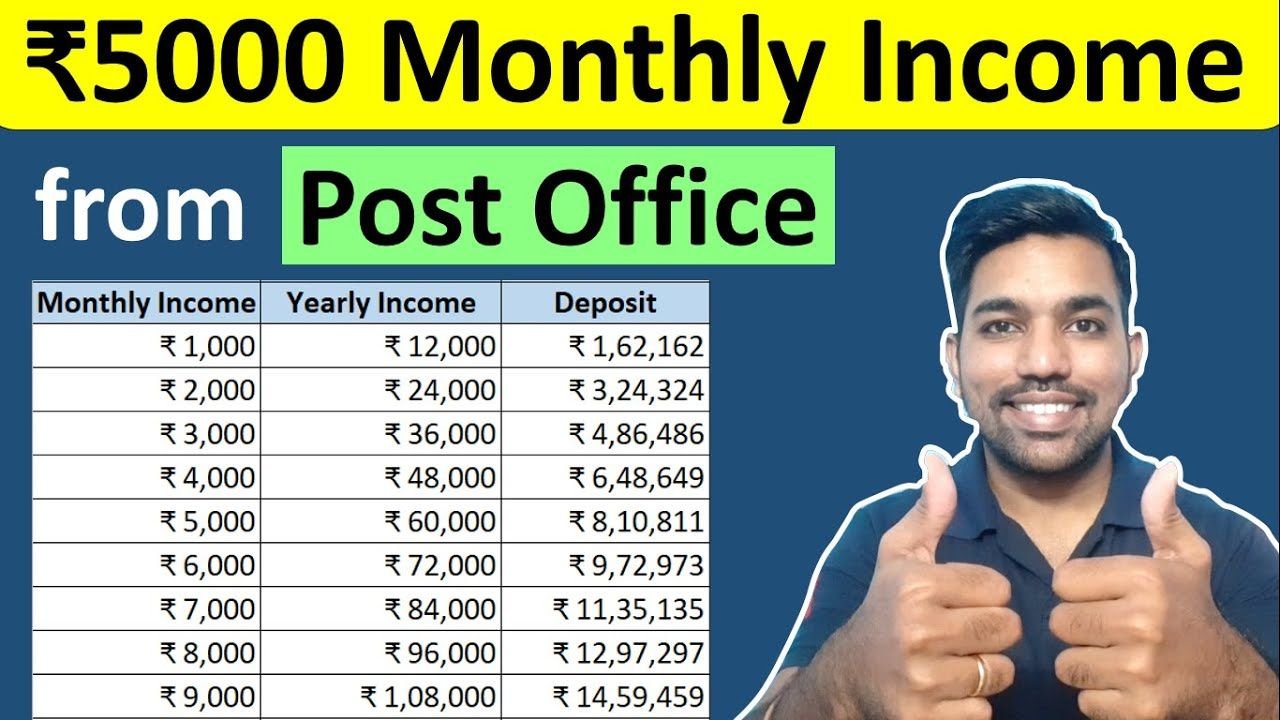

In this scheme, an individual deposits ₹5,000 every month into a Post Office recurring plan that is eligible for MIS. The money then earns interest. The current interest rate is around 6.6% per annum (subject to government revision).

Interest is calculated quarterly, but payments are made monthly, thereby giving investors a steady income. Regular deposits over 15 years develop into a huge corpus while generating steady income.

Important Features of the Scheme

The Post Office Monthly Income Scheme is a 5-year fixed deposit-type scheme, with the possibility of continuation. Deposits may be made in multiples of ₹1,000, with one deposit being a minimum of ₹1,000.

The scheme helps incorporate nominations, the transfer of accounts from one post office to another, and withdrawal on maturity. With monthly interest being credited, it is excellent for cash flow in the hands of retired persons.

Advantages of Monthly Income Scheme

The scheme offers various benefits that include the safety of capital, assured monthly income, and easy maintenance. Being government-backed, there is no question of default. It enables investors to schedule their monthly budget and inculcates a disciplined attitude in the investor towards savings. Rather than market-linked products, MIS is steady and predictable, comfort to all risk-averse investors.

Who Should Invest in MIS

The Monthly Income Scheme is a great plan for seniors, pensioners, or anyone who needs regular monthly income. It will also be appropriate for homemakers or people who wish to have a secure investment for emergencies, household pressures for which they do not have much money during the period, or are almost an alternative source of income along with pensions.

Tax Implications

Interest on a deposit under the Monthly Income Scheme will be taxable in accordance with the income tax slab of the depositor. Thus, the person gets a return without tax but with tax on its proceeds, an important matter to consider while planning investments.

Conclusion

The Post-Office Monthly Income Scheme is simple, safe, reliable, and a workable vehicle for paying semi-annual installments. Paying in installments of ₹5,000 monthly assures investors of a steady return.

It is an attractive option for a retiree and anyone looking for government backing for their investments. The coupling of scheduled savings and guaranteed returns grants peace of mind and offers a disciplined way to approach financial planning.